What to know about the Caseware Working Papers SME Template: The Deferred tax asset (liability) note

This article explains how to use the deferred tax asset (liability) note in the Caseware Working Papers SME Desktop Template. This document in no way constitutes a technical opinion on how to calculate deferred tax, neither does it express the full deferred tax disclosures. The only purpose of this document is to illustrate how to balance the note in the SME Template.

Instructions:

Scenario 1: Basic deferred tax asset and liability.

In this scenario, the deferred tax is fully raised through profit or loss and there are no assessed losses or tax credits.

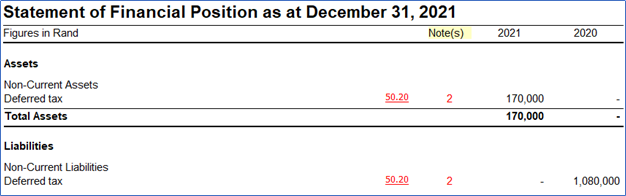

The following extract was obtained from the trial balance for the year ended 31 December 2021:

|

Acc number

|

Acc Name

|

2021

|

2020

|

2019

|

|

100

|

Deferred tax asset\(liability)

|

170 000

|

(1 080 000)

|

(680 000)

|

|

101

|

Deferred tax (profit) or loss

|

(1 250 000)

|

400 000

|

680 000

|

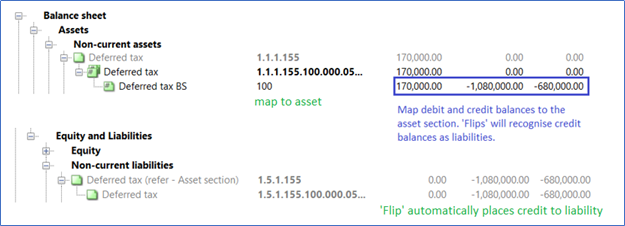

1. Deferred tax mapping

Map the full deferred tax asset or liability to the deferred tax ASSET mapping. It is not possible to map to the liability.

Map the deferred tax expense or income to “Taxation” in the “Income Statement/Other” mapping section. Again, the same mapping number is applied irrespective of whether the movement was a debit or a credit.

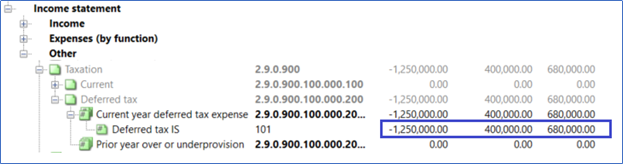

2. Balance sheet/ Statement of financial position

Once the deferred tax asset (liability) account has been mapped, the balance will either show as a net asset or net liability, depending on the signage as debit or credit.

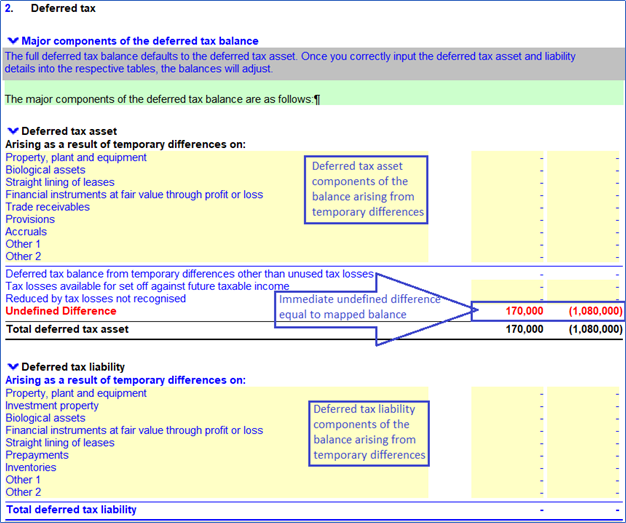

3. Deferred tax asset(liability) note

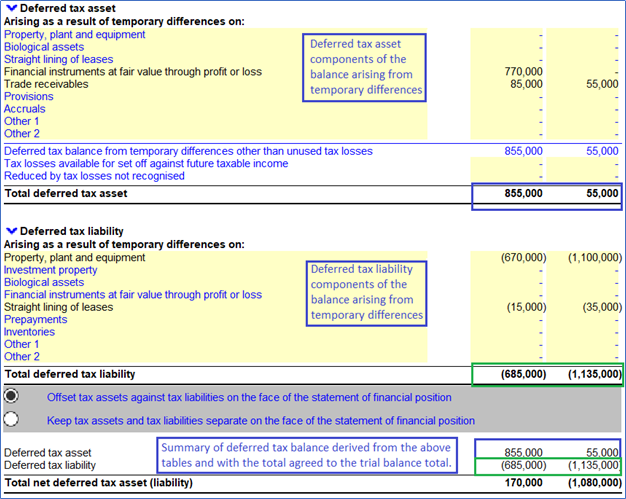

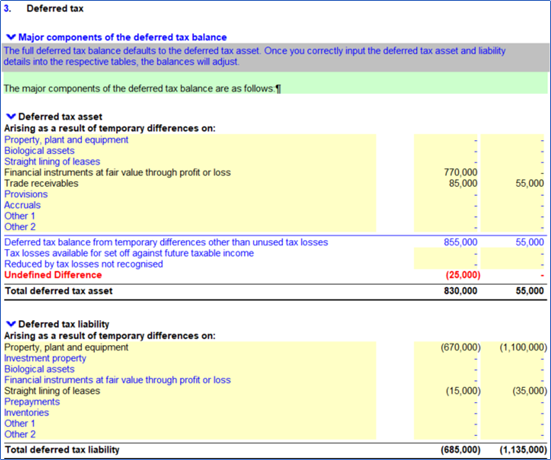

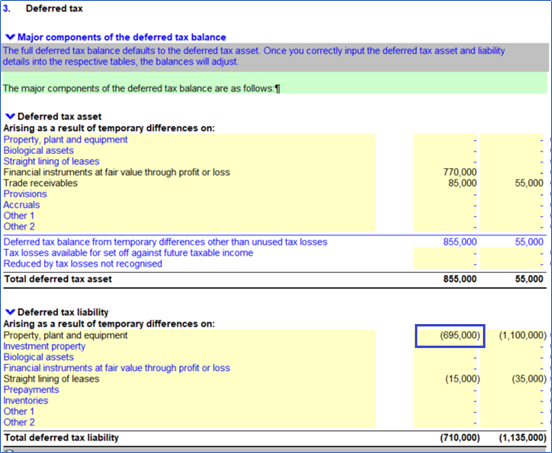

The first part of the note is for the major components of the deferred tax balance. It first presents a table where the deferred tax asset components of the balance must be disclosed. This is followed by another table where the deferred tax liability components are disclosed.

You will note that the deferred tax asset table contains an undefined difference equal to the mapped balance. This undefined difference will eliminate once both of the tables have been correctly populated.

The tables must be completed by typing in the correct values for each component of the deferred tax asset and liability, until the undefined difference is cleared.

The asset table must be completed by typing in positive values, while negative values must be typed into the liability table, as per the screen shot below.

4. Presenting deferred tax assets and liabilities either separately or set off on the statement of financial position

Notice from the previous image that there is a summary table and radio buttons after the deferred tax liability table. This summary table is derived from the deferred tax asset and liability components which were populated manually. The radio buttons determine the way the deferred tax is presented on the statement of financial position.

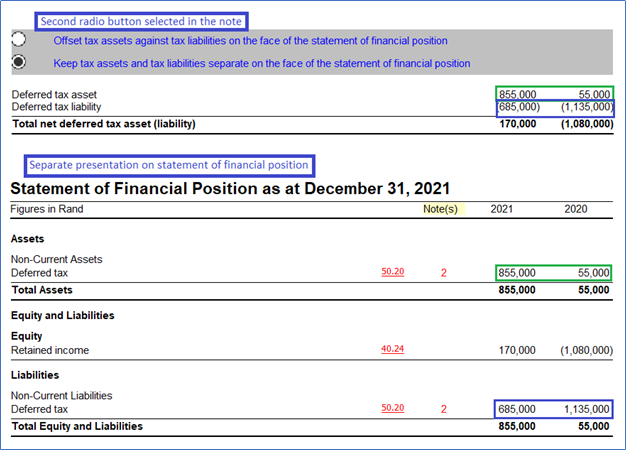

If the offset radio button is selected, then the net deferred tax asset or liability will be presented in the statement of financial position in the same way as it was shown at the beginning of this document.

If the second radio button is selected, to keep the deferred tax assets and liabilities separate, then the presentation on the statement of financial position will change as follows:

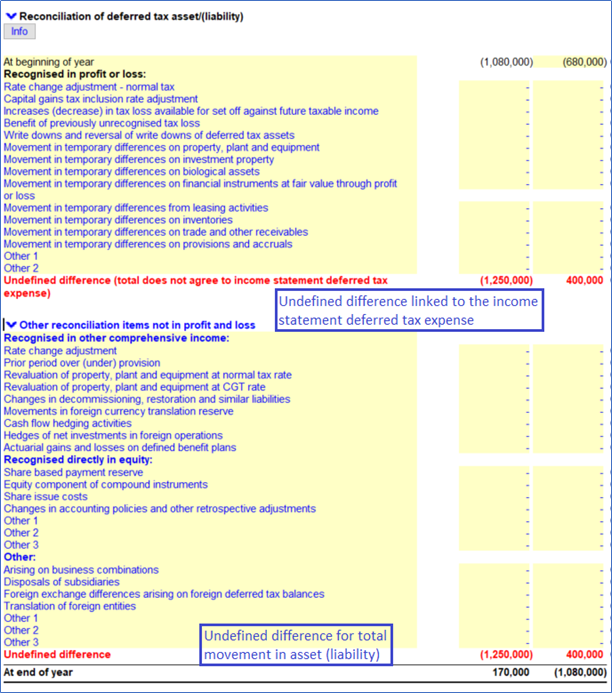

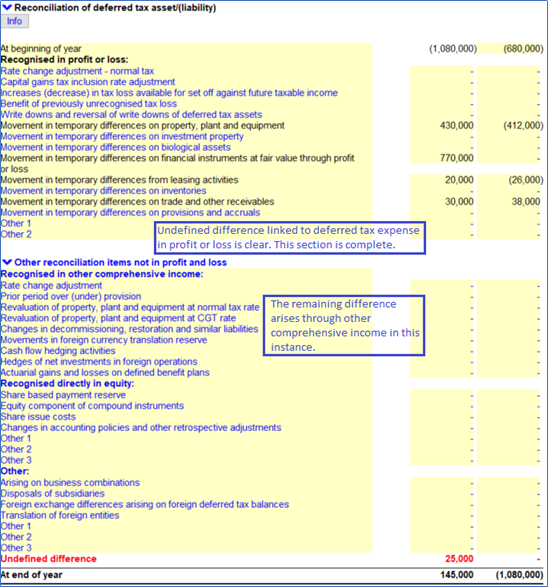

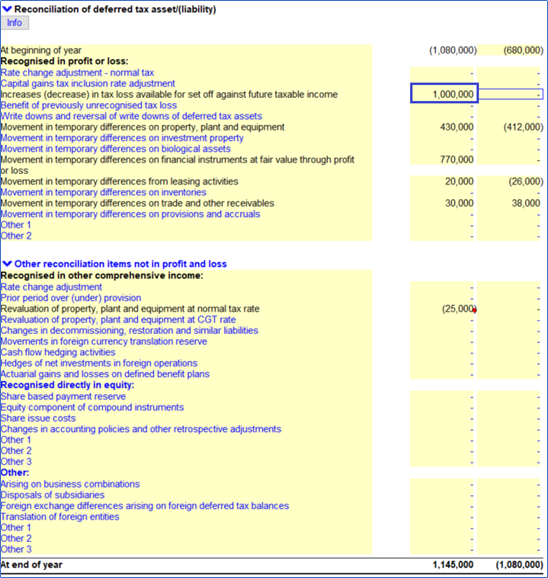

5. Completing the reconciliation of the deferred tax balance

This is the next section of the deferred tax asset (liability) note.

The reconciliation of the deferred tax asset /(liability) consists of two components:

- Movements recognized in profit or loss. This section of movement must agree to the deferred tax mapped to the deferred tax expense in the income statement section of mapping. However, this is the other side of the transaction, meaning that if an expense was raised in profit or loss, then this expense will reflect as a negative in this reconciliation.

- Other movements which could occur in the deferred tax balance, for example, through other comprehensive income or business combinations. These movements are expected to be less common and thus the section is collapsible.

The screen shot shows the reconciliation prior to populating any amounts.

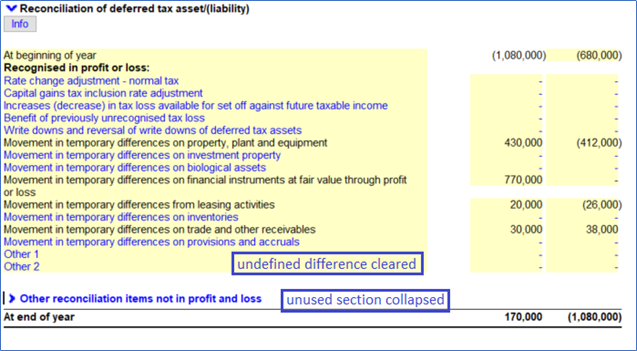

The movement in each temporary difference must be typed into the reconciliation and when the amount is in agreement with the deferred tax expense through profit or loss, the undefined difference is cleared.

6. Remainder of note

The rest of the note is not within the scope of this document.

Scenario 2: Basic deferred tax asset and liability with deferred tax also raised through other comprehensive income.

In this scenario, the information is the same except that the entity has now revalued buildings, resulting in deferred tax being raised through other comprehensive income and not only through profit or loss. The revaluation was for R100 000, of which R75 000 was recognized in the revaluation surplus and R25 000 increased the deferred tax liability.

The journal entry in 2021 for the revaluation was as follows:

| Dr Property, plant and equipment | 100 000 | |

| Cr Revaluation surplus (gross movement) | | 100 000 |

| Recognize gross revaluation of PPE | | |

| Dr Revaluation surplus (tax effect) | 25 000 | |

| Cr Deferred tax asset (liability) | | 25 000 |

| Tax effect of revaluation | | |

The following extract was obtained from the trial balance for the year ended 31 December 2021 after the above journal:

|

Acc number

|

Acc Name

|

2021

|

2020

|

2019

|

|

100

|

Deferred tax asset\(liability)

|

145 000

|

(1 080 000)

|

(680 000)

|

|

101

|

Deferred tax (profit) or loss

|

(1 250 000)

|

400 000

|

680 000

|

1. Deferred tax asset(liability) note

After processing the entry, the note will be out of balance to the extent of the R25 000.

Correct this balance by adjusting the temporary differences arising on property, plant and equipment.

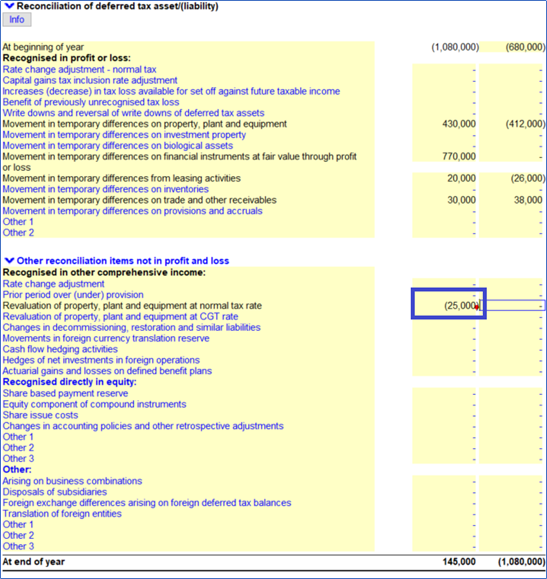

2. Completing the reconciliation of the deferred tax balance

The reconciliation of deferred tax will also be out of balance by the R25 000, as per the screenshot below. The undefined difference linked to the tax expense in profit or loss is still clear and so the remaining undefined difference has arisen in the “other reconciling items not in profit or loss”.

Type the correct movement through other comprehensive income into the reconciliation to clear the undefined difference.

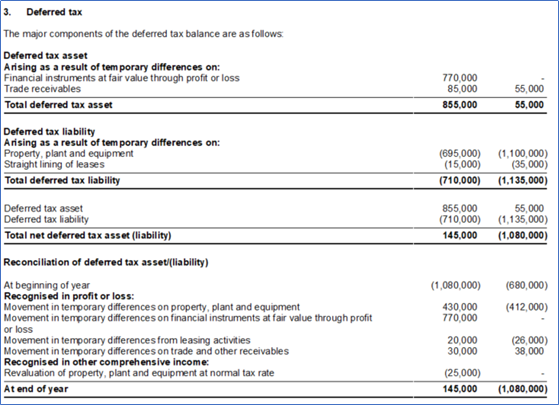

3. Print preview of deferred tax

The deferred tax asset (liability) print preview is shown below.

Scenario 3: The deferred tax asset includes an assessed loss.

In this scenario, the information is the same as for the previous 2 scenarios, except that the entity now also has an assessed loss in 2021.

Assume the assessed loss amounts to R5000 000. The deferred tax on this at 28% amounts to R1 400 000. However, the entity has determined that only R1 000 000 of the assessed loss may be recognized in terms of the IFRS for SME.

The journal entry in 2021 to recognize the deferred tax asset related to the assessed loss was as follows:

| Dr Deferred tax asset (liability) | 1000 000 | |

| Cr Deferred tax (profit) or loss | | 1000 000 |

| Recognize portion of deferred tax asset arising from assessed loss | |

|

The following extract was obtained from the trial balance for the year ended 31 December 2021 after the above journal:

| Acc number | Acc Name | 2021 | 2020 | 2019 |

| 100 | Deferred tax asset\(liability) | 1 145 000 | (1 080 000) | (680 000) |

| 101 | Deferred tax (profit) or loss | (2 250 000) | 400 000 | 680 000 |

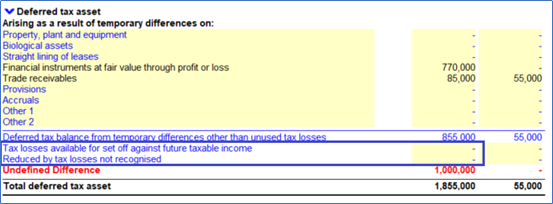

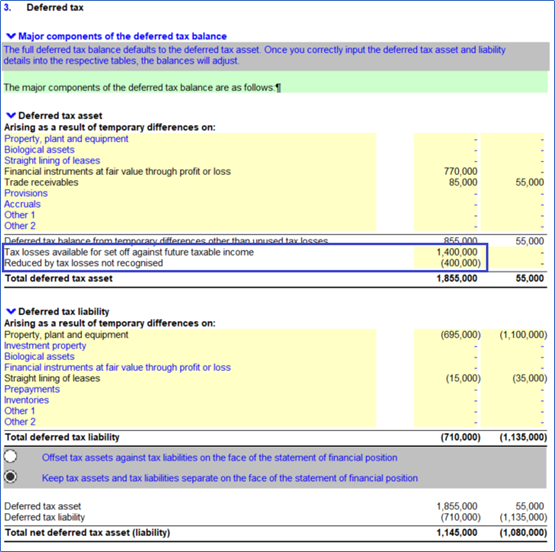

1. Deferred tax asset(liability) note

After processing the entry, the note will be out of balance to the extent of the R1 000 000. The screenshot only shows the deferred tax asset part of the note below.

The deferred tax asset arising from the assessed loss must be captured in the section within the blue block in the screenshot. The full amount available as a deferred tax asset from the assessed loss is disclosed and is then reduced by the amount not recognized, so that only the R 1 000 000 which was recognized remains.

The deferred tax arising from the assessed loss must be typed in to remove the undefined difference.

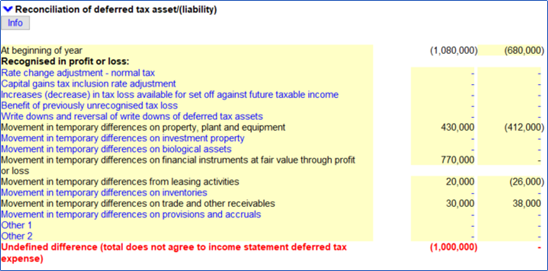

2. Completing the reconciliation of the deferred tax balance

The reconciliation of deferred tax will also be out of balance by the R1 000 000, as per the screenshot below. The undefined difference linked to the tax expense in profit or loss is showing because the deferred tax on the assessed loss was raised through profit or loss.

Correct the reconciliation to remove the undefined difference.

Rate this article:

|vote=None|

Processing...

(Popularity = 0/100, Rating = 0.0/5)

Related Articles

Getting Started | Mapping the trial balance

Principles of mapping the trial balance

Caseware Working Papers | How to create a new Mapping Number in Caseware Working Papers

How to add a new mapping number (including a Flip map number)

view all...