How do I update my Small Business Corporation (SBC) tax table?

Answer:

The best practice is to ensure your CaseWare Working Papers file has the latest version of the tax module (CTM).

To view the latest versions of Corporate Tax Module for CaseWare click here.

If your Corporate Tax Module in an older version then you will need to update to the latest version before applying any other recommended resolution.

NOTE: For the following you will require a Community login to download, if you do not have a Community Login click here.

To view the downloads available for the Corporate Tax Module for CaseWare Click here .

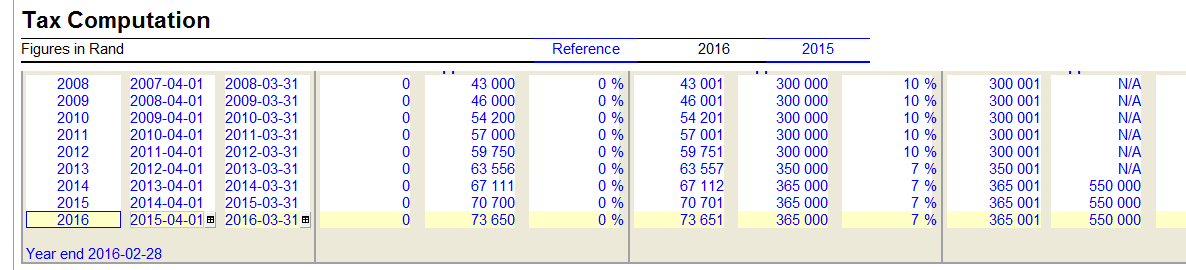

To update the current tax table with Small Business Corporation (SBC) tax rates should the latest update not have the current tax brackets, you will then insert these manually in the new input row as per the tax tables for SBC, to perform this procedure you may use the following steps:

- Once document 50.50.20 is opened and you have selected the radio button “The entity is a Small Business Corporation” and the table is now displayed.

• Select Options | Builder mode ( Click here for information on how to access Builder Mode)

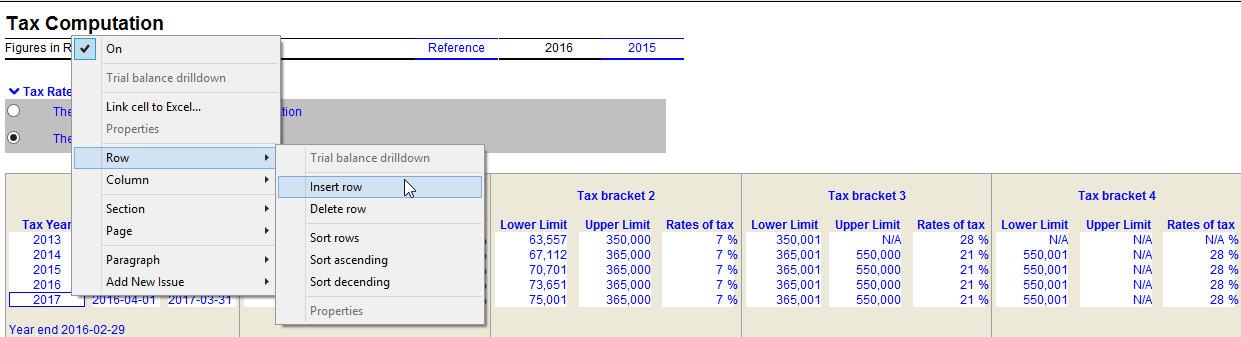

• Then place your cursor on the last row within the table, Right Click and select Row | Insert Row.

The new input row will now appear, please ensure that the cells are input fields so that you can type in the values as per the latest tax table. this information can be found from the SARS website: http://www.sars.gov.za/

• To convert a cell to an input cell, Right click then select Toggle input cell

Rate this article:

|vote=None|

Processing...

(Popularity = 0/100, Rating = 0.0/5)

Related Articles

Corporate Tax Module | What to do if the Tax Computation is not computing?

Practice Management Suite | How do I resolve a Year End Close (YEC) or rollover error in TaxWare and SecWare?

Corporate Tax Module | What to do when the Tax Computation profit does not agree to the profit on the Income statement?

Getting Started | Year end close

view all...